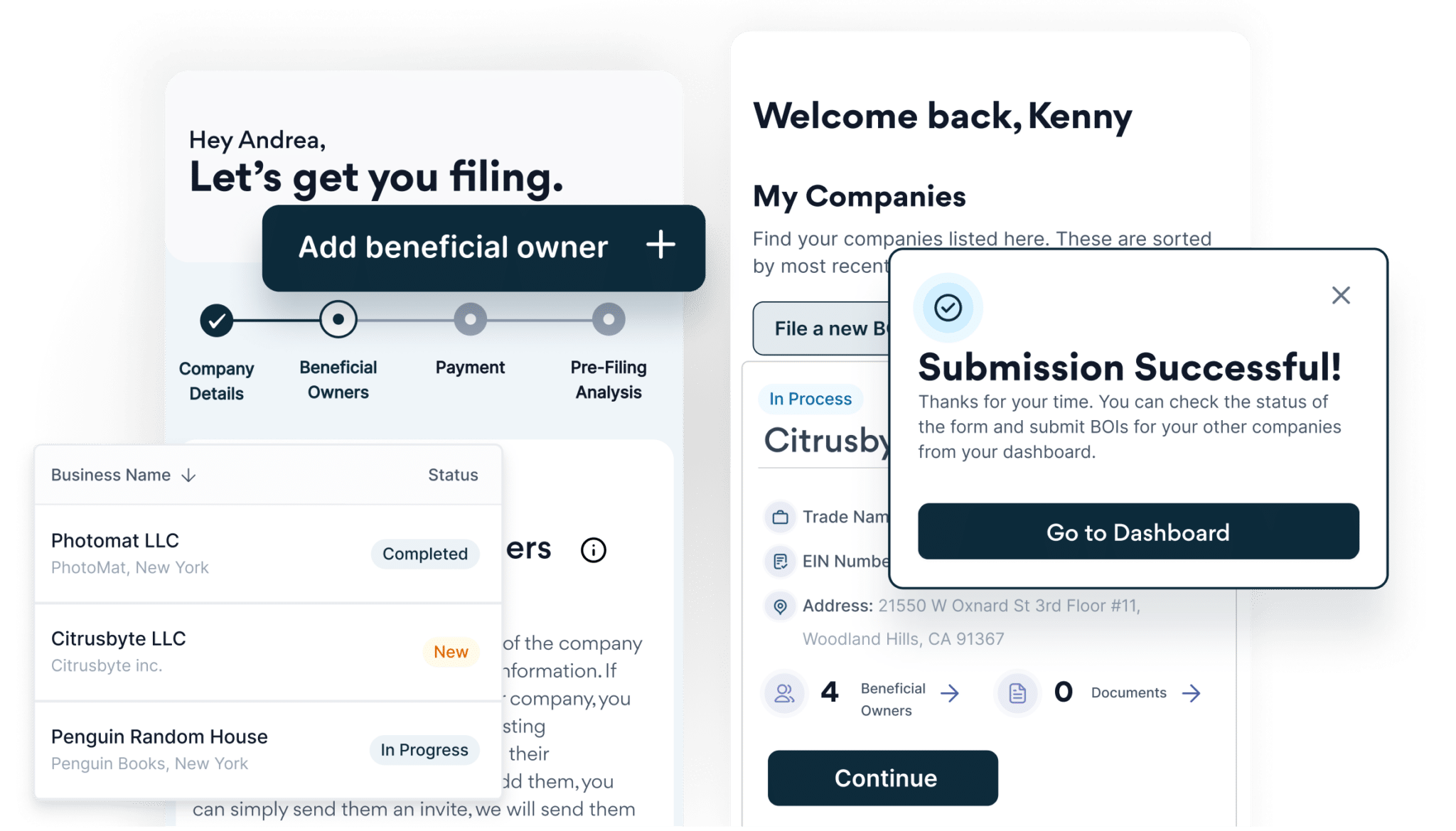

Our state-of-the-art filing platform streamlines the BOI filing process, ensuring accurate and complete submissions within just ten minutes. Enabling you to allocate more time to reinvest in your business and enhance its growth.

The CTA was signed into law on January 1, 2021, with a focus on preventing financial crime and money laundering within the US. Bad actors seek to conceal their ownership of entities, to facilitate money laundering, funding of terrorist activity, tax evasion, and other financial crimes.

Reporting companies will be required to file a BOI report with FinCEN and maintain up-to-date information on their companies and their beneficial owners within 30 days of a change(s).

Effective January 1, 2024, all US and foreign companies that were formed in, or have registered with any of the 50 US states, must comply with new Beneficial Ownership Information (BOI) reporting requirements with the Financial Crimes Enforcement Network (FinCEN), as prescribed by the Corporate Transparency Act (CTA).

The Beneficial Ownership Information report (“BOI”) is required to be filed by reporting companies entities starting January 1, 2024.

BOI Reports include information about the reporting company, the reporting company’s beneficial owners, and “company applicants” who assisted with the filings to create the entity.

The potential penalties for this violation can be severe, including a daily fine of up to $500 for each day the issue remains unresolved. Additionally, there’s a possibility of being fined up to $10,000 and/or facing imprisonment for up to 2 years.

Streamline Your BOI Report Filing with Ease

BOI Professionals is the nation’s trusted partner for CTA and BOI compliance.

We serve businesses of all shapes and sizes, from small shops to large businesses, as well as their advisors.

We haven’t gotten here accidentally. We’re consistently dedicated to:

Saving our clients time and money, utilizing cutting-edge technology to make complex reporting simple and secure.

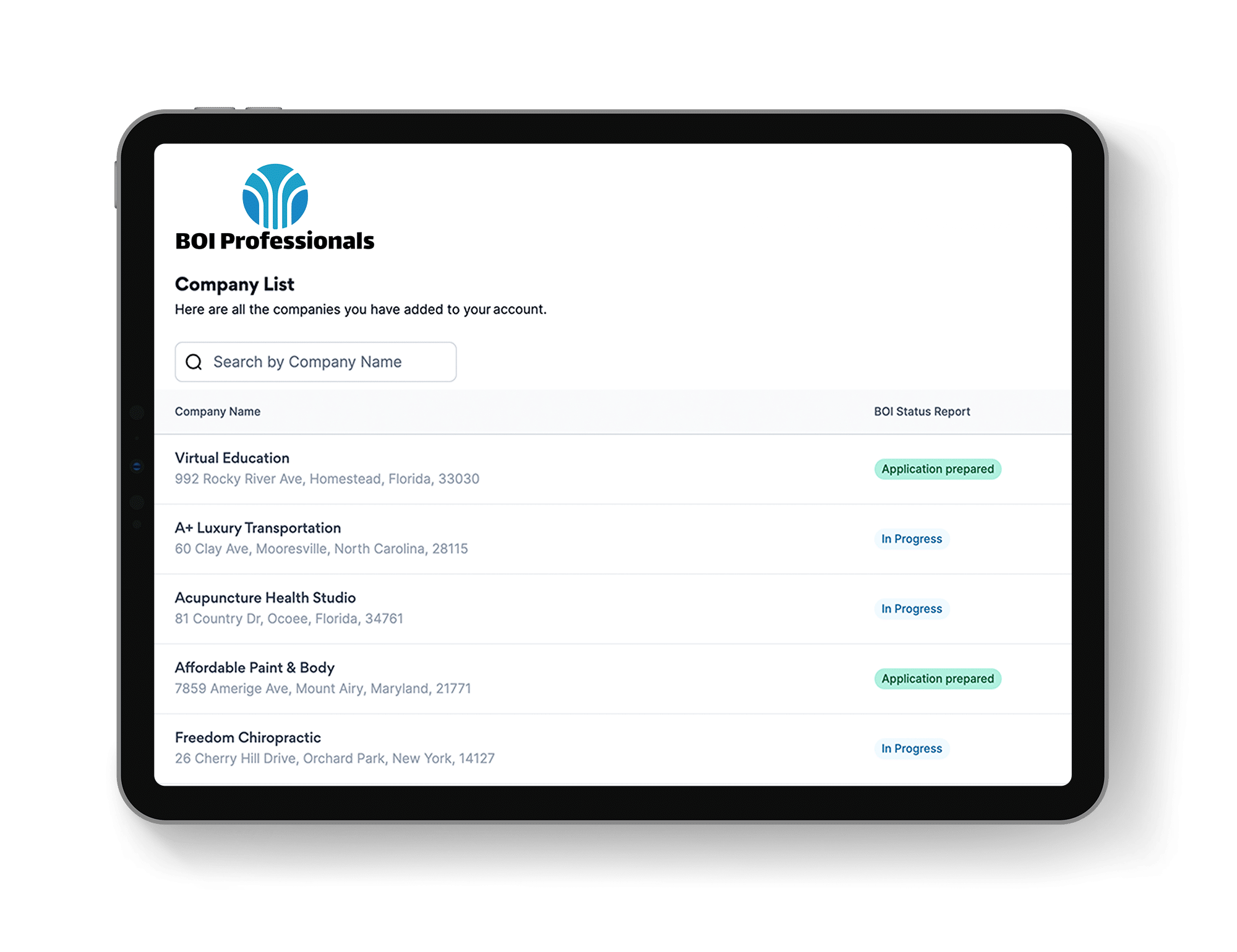

Making it easy to load and file bulk information with ease.

Helping FinCEN obtain the data they need as quickly and easily as possible.

Enabling enterprise clients, such as accountants and attorneys, to file BOI reports and serve their clients with speed and accuracy.