FileForms recently had the privilege of attending the NPRRA (National Public Records Research Association) conference, and what a gathering it was. The event brought together a fantastic group of people—key stakeholders across FinCEN, registered agents, and corporate formation services providers—offering industry insight and valuable takeaways on the Corporate Transparency Act (CTA) compliance and Beneficial Ownership Information reporting landscape. Here’s a breakdown of the key points and discussions that took place in Providence, Rhode Island, during this year’s 50th Anniversary conference.

So far, FinCEN has received just 4.3 million Beneficial Ownership Information Reports (BOIRs) under the CTA. However, this is just the beginning—nearly 30 million more reports are expected to be filed before the deadline. This puts the current progress into perspective and signals that businesses cannot afford to delay their filings much longer.

One of the highlights of the conference was a helpful Q&A with FinCEN’s Philip Lam, Beneficial Ownership Operations and Innovation Chief, where he addressed recent FAQs focused on dissolved entities and shared their plans to increase national awareness amongst business owners. FinCEN will launch major awareness campaigns starting in late September, partnering with national television, radio, and major news outlets to spread the word about BOI filing requirements.

FinCEN provided some clarity regarding their ticketing system for filer issues. Their system is designed to handle queries efficiently, but FinCEN strongly advises filers to avoid waiting until the last minute, as the system will be dealing with unprecedented form volumes and could potentially reach capacity.

One thing became clear after attending two live discussions with FinCEN in the last month: the deadline is unlikely to be extended. Although there are ongoing district and circuit court cases regarding aspects of the CTA’s constitutionality, no final verdicts are expected before the end of the year. Therefore, businesses should act now and file their BOI report to avoid penalties.

FinCEN revealed that over 1,000 businesses have applied for access to their API to streamline BOIR filings for business owners. However, the surge in applications has led to fraud concerns, particularly from businesses with limited operational history. As a result, FinCEN has had to introduce fraud detection protocols, emphasizing the need for businesses to have some operating history prior to being granted access to their API.

A recurring message throughout the conference was FinCEN’s concern about a last-minute rush of BOIR filings. FinCEN warned that the portal could crash under pressure since this will be the first time such a large volume of forms is processed through their system. To avoid issues, businesses are encouraged to file early and not procrastinate until the final days of the deadline.

FinCEN anticipates that the first fines for CTA non-compliance will likely target high-profile cases—think along the lines of an “Al Capone” scenario. The reasoning behind this approach is to make a statement and set a precedent for future enforcement of CTA regulations. Companies found to be ignoring the law may face significant penalties of $591 per day, up to $10,000 with criminal and civil penalties to follow.

Another key insight was how lack of timely or complete BOI reporting could be used as a tool to expedite the prosecution of criminals. Entities or individuals already involved in serious crimes or prolonged court cases may find themselves under the spotlight for BOI non-compliance as part of broader investigations.

Several three-letter agencies—such as the IRS, FBI, and others—already have access to the BOI reporting database that FinCEN has created. This access enables them to actively monitor filings for irregularities or red flags. Additionally, FinCEN holds a comprehensive list of active U.S. entities, comparing those with filed BOIRs and identifying any businesses potentially disregarding the law.

One of the standout advantages of attending the NPRRA conference and partnering with many of its members is the group’s unique relationship with FinCEN. This access allows members to stay informed on the latest developments, including the intricacies and challenges of CTA compliance, helping them better serve their clients.

Despite facing budget constraints and limited resources, FinCEN is doing everything in its power to ensure a smooth rollout of the CTA. This law represents a major shift in corporate compliance history, and their efforts to support businesses, while monumental, are not without challenges.

A final, fascinating dynamic of this conference was the spirit of collaboration. In an industry where competition often reigns supreme, NPRRA members exemplify how creative thinking and innovation thrive even among competitors. The shared goal of serving clients’ state and federal compliance needs brings together like-minded professionals, each with their own approach but united by the same mission.

If one message came through loud and clear at this year’s NPRRA conference, it’s that businesses should not wait to file their BOI reports. With no formal extension on the horizon and mounting pressure on FinCEN’s reporting and service system, early compliance is key to avoiding penalties and ensuring your business meets its CTA obligations.

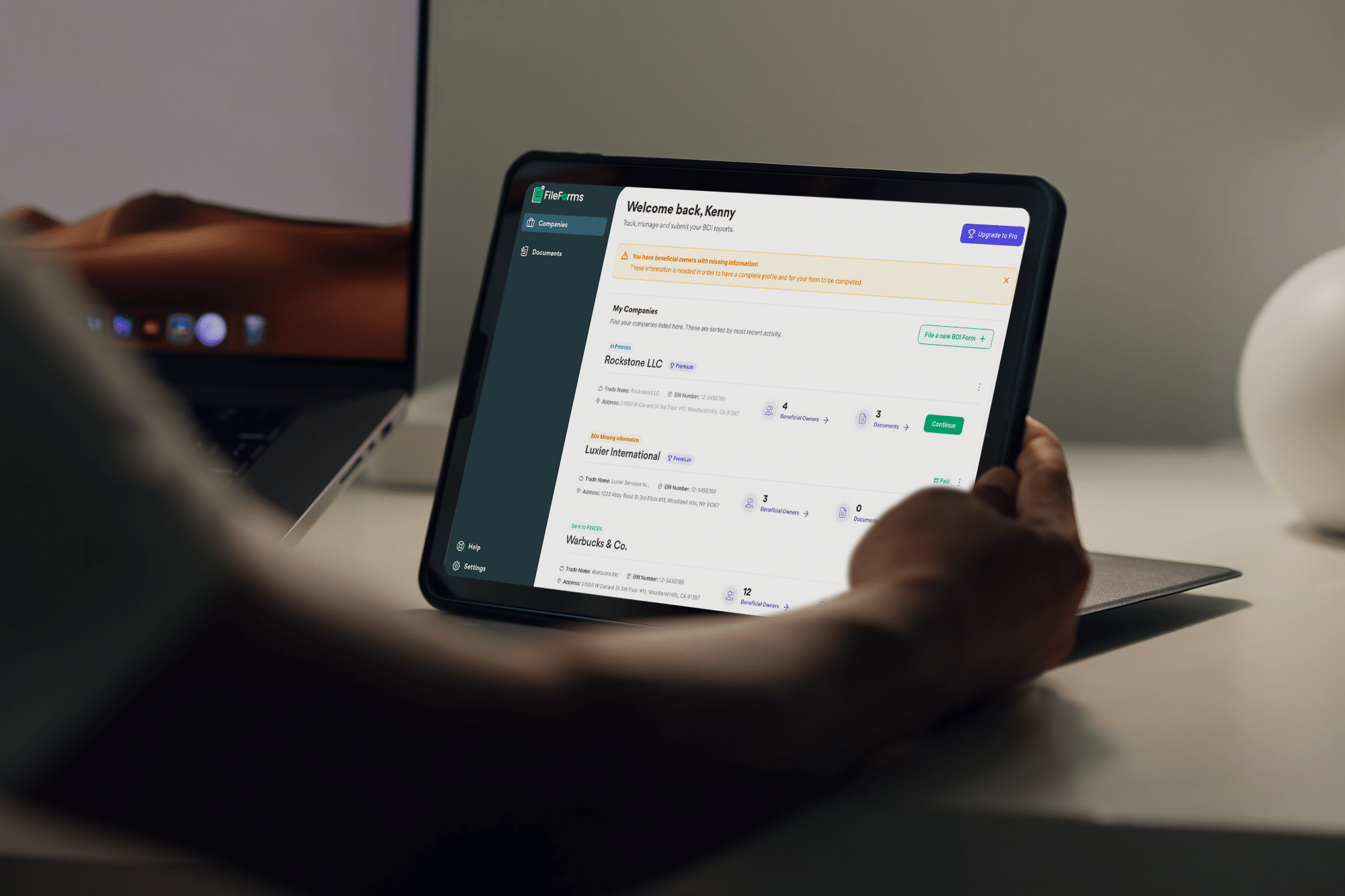

For more information on how to streamline your BOI reporting process, visit https://www.fileforms.com and get ahead of the curve.

Please visit the links below for additional information, resources, and webinars.